BTN News: The Colombian government is considering a revival of the popular ‘Days Without VAT’ initiative, a move aimed at boosting the country’s economy by promoting local products. Initially introduced as a measure to stimulate consumption during the pandemic, the initiative was halted under President Gustavo Petro’s administration, citing its limited impact on economic growth. However, recent discussions led by Finance Minister Ricardo Bonilla have revealed a potential shift in strategy. This time, the focus is on implementing the VAT exemption exclusively for goods produced in Colombia. With renewed interest from both the government and industry stakeholders, including the National Association of Industrialists (ANDI), this new version of ‘Days Without VAT’ could offer a fresh approach to stimulating the local market.

Government Reconsiders ‘Days Without VAT’

The Colombian government is actively exploring the reintroduction of the ‘Days Without VAT’ program, but with a new twist. Initially terminated by President Gustavo Petro’s administration due to concerns over its effectiveness, this program may make a comeback with a focus on local products. Finance Minister Ricardo Bonilla highlighted that previous objections were rooted in the program’s promotion of imported goods rather than supporting national industry.

New Proposal for 2024: Focus on National Products

Minister Bonilla has confirmed that the government is currently reviewing a proposal put forth by the National Association of Industrialists (ANDI). This new plan suggests reinstating the ‘Days Without VAT,’ but solely for products manufactured in Colombia. The goal? To stimulate local industry, create jobs, and drive economic growth from within. According to Bonilla, “The government objected to the previous ‘Days Without VAT’ days because they were primarily oriented towards imported goods. We are now reviewing the ANDI’s proposal, which recommends applying the VAT exemption exclusively to nationally-produced items.”

Why the Change in Policy?

The initial cancellation of the ‘Days Without VAT’ program under the current administration was primarily driven by concerns that it did not significantly benefit the Colombian economy. A substantial portion of the products that received the VAT exemption were imported, providing little to no advantage to local manufacturers. This time around, by focusing on national products, the government aims to ensure that any economic benefits from the initiative remain within the country.

Boosting Local Industry: A Win-Win Strategy

By shifting focus to products made in Colombia, the proposed policy change could encourage more domestic production and consumption. This approach not only supports local businesses but also aligns with the government’s broader economic agenda to reduce reliance on imports. The ANDI has advocated strongly for this approach, arguing that it could offer much-needed relief to Colombian manufacturers facing challenges in a highly competitive global market.

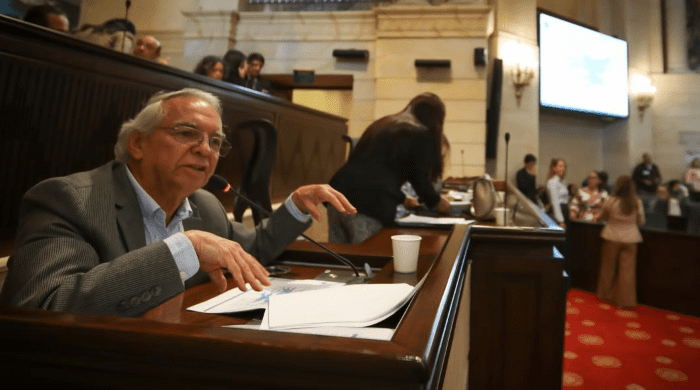

Recent Developments: Congressional Pushback

Despite the renewed interest in reviving the ‘Days Without VAT,’ there have been hurdles. The Colombian House of Representatives recently rejected the government’s objections to the legislation aimed at reinstating these special shopping days. The vote, with 72 members opposing the government’s stance, has added pressure on the administration to find a middle ground that satisfies both the legislative body and economic objectives.

Future of ‘Days Without VAT’: What’s Next?

As the government evaluates the ANDI’s proposal, a key question remains: Will a national-only VAT exemption day truly stimulate economic growth in Colombia? With debates heating up, the final decision is expected to have significant implications for both consumers and local businesses. For now, all eyes are on the government to see if this new approach can balance fiscal responsibility with economic stimulation.

Conclusion: A New Path Forward for Colombia?

The potential revival of ‘Days Without VAT’ with a focus on local products represents a strategic shift for Colombia’s economic policy. By prioritizing domestically produced goods, the government hopes to achieve greater economic impact and sustainability. Whether this initiative will proceed depends on further negotiations and the outcomes of upcoming legislative sessions. As Colombia navigates these economic challenges, the decision on the ‘Days Without VAT’ could set a precedent for future tax and economic policies.