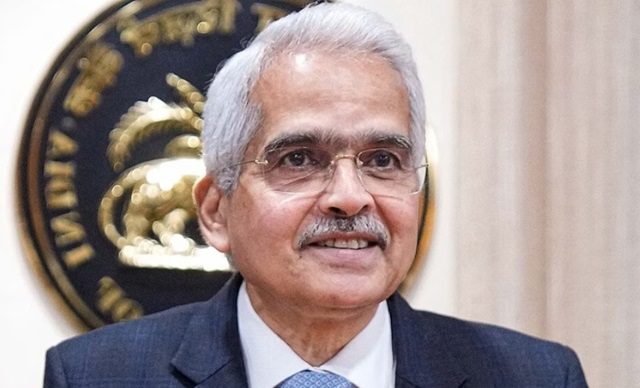

BTN News: Speaking at the Second Global Conference on Financial Resilience organized by the College of Supervisors, RBI Governor Shaktikanta Das underscored the steps taken by the central bank to preempt such risks arising out of unsecured loans. While delivering his keynote address, Governor Das emphasized the importance of “sound credit assessment procedures and robust risk management frameworks” in preserving the stability of the financial system.

They demonstrate the efficiency of the interventions that we undertook at the appropriate time to moderate growth in unsecured credit,” governor Das said. Unless such steps were taken, the frailties embedded in open-ended lending could have “led to a bigger picture issue,” he cautioned. This vigilant approach follows after a dramatic increase in demand for non-collateralized loans or unsecured loans, a type of loan that does not have any collateral tied down to reduce the risk of the default.

Front Loaded and Risk Based Measures

In a move that diverges from the recent global trend, last year RBI took a proactive step to rein in household credit by raising the risk weight for both commercial banks and non-banking financial companies (NBFCs) which lends for consumer loans by 25 percentage points. Earlier, such loans carried 100 percent risk weight which has now been revised to 125 percent. The measure is aimed at making banks and NBFC system more resilient to potential defaults in the times of deep financial stress.

Demand for Tougher Checks and Balances is in Call

Reserve Bank of India Governor attended banks and NBFCs to heighten the vigil saying that pursuit of growth in business should not lead to compromises in underwriting standards and improper pricing. “Strong risk mitigants are crucial to ensure the sustained success and resilience of a regulated entity, and indeed the system as a whole,” he said.

The responsibility of managers and new technologies

Drawing attention to the crucial role of supervisors, Das sought to encourage them to be proactive in anticipating crises. He added that the RBI is best-placed given its unique powers and resources to anticipate and arrest any financial problems before they become unmanageable. We are trying to sniff a crisis…. This has turned supervision into a very complicated thing, so our methods must also change with new developments,” he said.

He also highlighted the power of new technologies like artificial intelligence (AI) and machine learning (ML) that could be harnessed for predictive analysis. Such technologies can enable banks and NBFCs to more accurately detect possible risks as well as trends and thus, reinforce the entire risk management setup.

Post-Pandemic Financial Resilience

Attributing to the general state of the Indian financial system, Das pointed out that there is a significant transformation in the country since COVID-19 occurred. “India’s domestic financial sector is now significantly stronger, with higher capital buffers, improved asset quality and more importantly increased profitability of banks and NBFCs,” he said. But he did caution about complacency, saying the focus needs to be on maintaining what has worked and not just moving on once progress is made.

Conclusion

The address by Governor Das reiterates the RBI’s resolve at maintaining financial stability through timely interventions, strong risk management and judicious application of cutting edge technology. With the changing contours of the financial system, these steps become important in reducing risks and making India’s financial system fireproof.