BTN News: The European Central Bank (ECB) will likely keep interest rates the same at its meeting on Thursday. This decision depends on new inflation numbers, which could lead to a rate cut in September. In June, the ECB cut interest rates by 0.25 percentage points. This was the first cut since 2019. The ECB had started raising rates in mid-2022 to control rising prices, especially in energy and food.

Analysts Believe Interest Rates Will Stay the Same Due to Inflation Worries

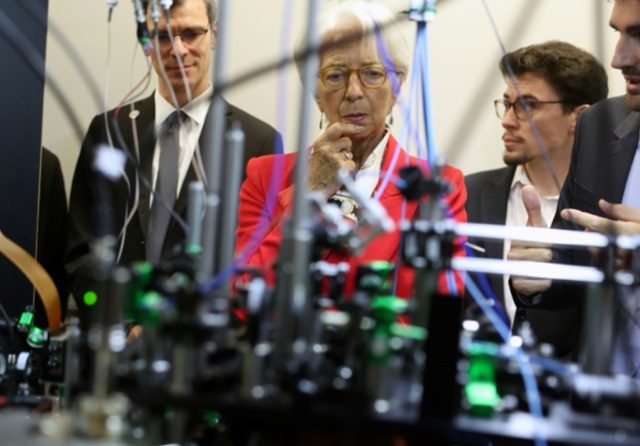

Most analysts think the ECB, based in Frankfurt, will keep deposit rates at 3.75%. The rate cut in June showed that the cycle of raising rates, which began in July 2022, might be over. However, the ECB warned that inflation is still unpredictable. ECB President Christine Lagarde will give a press conference at 14:15 CET (12:15 GMT) on Thursday. Many will listen carefully for updates on the economy and inflation.

Investors Calm Despite Global Issues and Political Unrest in France

The main goal of the ECB’s meeting is to avoid any surprises as the holiday season approaches, says Carsten Brzeski of ING. Investors felt better after U.S. Federal Reserve Chairman Jerome Powell spoke positively about the slowdown in inflation in June. This increased hopes for a rate cut in September. The ECB seems sure that inflation will go back to its 2% target by the end of 2025, according to Deutsche Bank economist Mark Wall. However, the ECB needs more proof that inflation and wage increases are slowing down before cutting rates again.

Current Economic Signals and Future Plans Based on New Data

Since the last ECB meeting, data has shown weaker economic growth and a slight drop in inflation, which was 2.5% in June compared to 2.6% in May. But core inflation, which does not include energy and food prices, stayed the same at 2.9%. The rise in service prices, which are influenced by wages, is a concern. They went up by 4.1% in June, adding to overall inflation.

Possible Rate Cut in September Amid Political Uncertainty in France

The mixed economic signals suggest a possible rate cut in September when the ECB will release new growth and inflation forecasts, says Felix Schmidt of Berenberg. Lagarde will likely face questions about the political situation in France. Political groups there are trying to form a coalition after the elections. France needs to quickly address its budget plan to regain fiscal flexibility, according to IMF Chief Economist Pierre-Olivier Gourinchas.

Effect on French Bonds and the ECB’s Careful Approach

Political uncertainty in France could affect French bond yields, which might lead to ECB intervention. Lagarde is expected to emphasize that the ECB is watching market developments closely. She will also likely remind that Eurozone countries must follow agreed budget rules, as noted by Deutsche Bank. This careful approach aims to reassure markets and keep stability amid ongoing economic and political issues.

In conclusion, the ECB’s upcoming meeting is expected to keep interest rates steady while watching new inflation data and political developments. A possible rate cut in September depends on more signs of economic stability and lower inflation pressures.