BTN News: In today’s digital age, protecting your personal information is more important than ever. With cybercriminals constantly devising new ways to access sensitive data, phishing has emerged as one of the most common and dangerous threats online. These attacks often come in the form of fake emails, text messages, or websites that seem legitimate but are designed to trick you into giving away private details such as passwords or bank information. Knowing how to spot and avoid phishing scams is essential to safeguard your data. In this article, we share five crucial tips from Banco Popular to help you identify and prevent phishing attacks in 2024.

1. Stay Skeptical of Unsolicited Messages

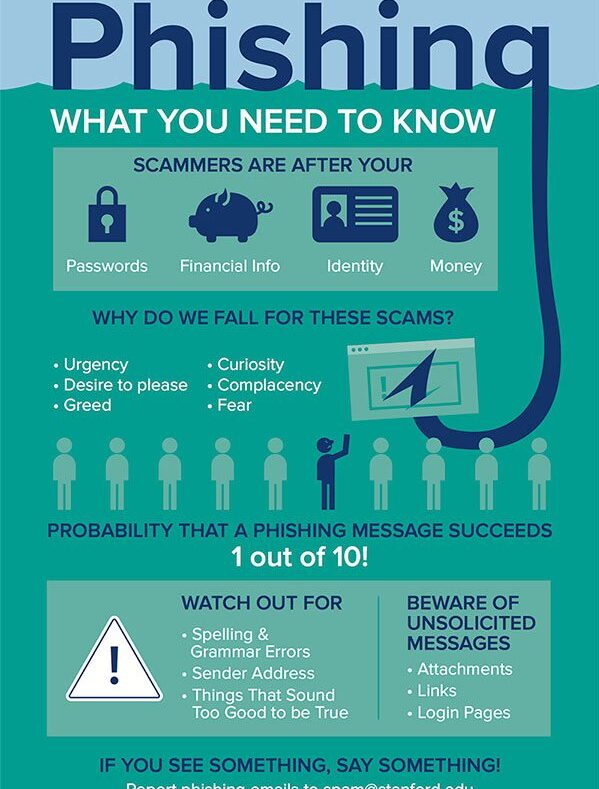

It’s crucial to approach unexpected messages—especially emails and texts—with caution. Cybercriminals frequently disguise themselves as trustworthy entities, sending communications that appear legitimate at first glance. Look for signs of phishing like poor spelling or grammatical errors, unusual email addresses, or suspicious links. Always verify the sender before clicking on any links or downloading attachments. When in doubt, navigate directly to the website of the organization mentioned instead of following a link in the email.

2. Think Twice Before Sharing Personal Information

Before sharing sensitive information online, take a moment to evaluate the request. Reputable institutions will never ask for confidential details, such as passwords or bank information, via email or text. Be wary of unsolicited requests—like messages claiming you’ve won a prize or need to verify your account details urgently. These are often phishing attempts designed to steal your personal information. Always use official websites and verified platforms when entering any private data.

3. Keep Your Devices and Software Updated

Ensuring your devices are up to date is a simple yet effective step in protecting your personal information. Regular updates for operating systems, browsers, and apps often include security patches that address newly discovered vulnerabilities. Enable automatic updates whenever possible and consider using multi-factor authentication (MFA) for an added layer of security. MFA requires an additional verification step, such as a code sent to your mobile phone, making it much harder for cybercriminals to access your accounts.

4. Install and Maintain Robust Security Software

Defending against phishing attacks starts with comprehensive security software. Install reputable antivirus and anti-malware programs on all your devices and keep them updated regularly. Cybersecurity isn’t just an IT issue; it’s everyone’s responsibility. Encourage your colleagues, friends, and family to use security software and educate them on recognizing phishing attempts. The more people are aware of these threats, the safer the digital environment becomes for everyone.

5. Always Verify Requests for Sensitive Information

If you receive a request for sensitive information that seems unusual, don’t rush to comply. Instead, contact the company directly through official channels—such as their customer service phone number or their verified website. Never provide personal details in response to unexpected requests. For example, if a message appears to be from a delivery service asking you to confirm your details, first check directly with the company to ensure it’s a legitimate request.

Why Phishing is a Growing Concern in 2024

Phishing attacks are evolving rapidly, becoming more sophisticated and harder to detect. With the rise of remote work and increased online activity, cybercriminals have more opportunities than ever to target unsuspecting users. As phishing techniques become more advanced, it is crucial to stay informed and vigilant to protect your personal and financial data. By following these expert tips from Banco Popular, you can reduce your risk of falling victim to a phishing scam.

How to Stay Informed and Protect Yourself

Stay proactive by subscribing to cybersecurity news and updates. Banks and security organizations often release alerts and advice on new phishing trends. Regularly review your bank statements and account activities for any unauthorized transactions. Remember, your vigilance is your best defense against phishing scams.

Conclusion: Stay Safe, Stay Alert

By remaining aware and cautious, you can significantly reduce your risk of falling prey to phishing scams. Incorporate these strategies into your daily digital habits and encourage others to do the same. Remember, protecting your personal information is a continuous process that requires constant attention. Stay alert, and stay safe.